Analyzing the Repo Rate Factor Amidst The Covid-19 Pandemic

Author: Anushka Maske, 4th-year B.B.A. LL.B. (Hons.) student at Symbiosis Law School Pune & Samarth Gosavi, 4th-year B.B.A. LL.B. (Hons.) student at Symbiosis Law School Pune

INTRODUCTION

Recently, for consecutively for 3rd time since February 2025, RBI cut the repo rates, cutting it by 50 basis points bringing it to 5.50%. It has also cut the Cash Reserve Ratio by 1%, bringing it to 3%, stimulating the growth. This means borrowing cost will be lowered due to repo rate cut and banks will have approximately 2.5 lakh crores more with them, to lend the prospective borrowers. This injects liquidity and stimulates growth in the market. RBI’s is decision is being welcome by stakeholders across sectors as the one that stimulates demand and supply of lendable money and hence will increase the economic activity.

Similar to the current situation where RBI has wisely utilized its instruments in the interest of the economy as a whole, during the pandemic, RBI responded utilizing the instruments to ensure economic stability. MPC’s decisions with respect to repo rates, reverse repo rates, and several other instruments available to central bank to control inflation and impact the economy of the country substantially, were designed to cope with the economic emergencies created by Covid-19 pandemic across the globe in 3rd and 4th quarters of FY 2020-21.

Taking this as our backdrop, in this research article, authors intend to analyse the monetary policy response to the pandemic, particularly in terms of repo rate. Authors also compare RBI’s response to pandemic with that of other Central Banks. The paper concludes with the lessons drawn from the comparison, which could be fruitful for the future emergencies if any. However, it is pertinent to first understand how RBI ensured economic stability amidst pandemic.

RBI’S RESPONSE TO PANDEMIC

It is widely agreed that RBI’s action on the onset of the pandemic, compared to its actions a couple of years preceding the pandemic, were really quick, and positively and rightly so. As Lekha Chakraborty rightly points out, RBI had to amend policy rates to infuse liquidity in market while still not losing focus from long term vision, and the unprecedented scale of the pandemic called for “unprecedented policy response.” Amidst pandemic, while unemployment rate hiked from 5.27% in 2019 to 8.00% in 2020, and salary cuts were unprecedented, in order to inject liquidity in the market, RIB reduced repo rate, reverse repo rate, CRR, SLR. When repo rates and consequently reverse repo rate is reduced, loan becomes cheaper and thus, people can avail more credit facility alluring them to utilize those credit facilities, which eventually increases demand. Increasing unemployment and salary cuts were bound to affect the demand and thus this stimulus was essential. The idea was to encourage the flow of surplus funds with RBI into the market and stimulate the economy.

However, reducing the rates to a very low level would have increased demand to an unprecedented extent, increasing inflation. Thus, it was essential to strike the rate at which the liquidity is injected but increasing demand does not hike inflation.

As the vaccination drive gathered pace, the lockdowns were lifted and, economy was recovering; RBI started increasing the rates gradually and this stabled the inflation. This process of increasing rates and decreasing them again, as the country recovers from the pandemic, was likely to be short-term considering the pace at which global healthcare sector was working on developing vaccine; and thus, inflation rise which Indian market could accommodate for short term at least, was worth risking. Thus, by taking a calculated risk of rise in inflation, to inject liquidity and eventually increase demand, RBI reduced the repo rates, and rightly so.

Now let us see how other central banks dealt with the same issue, more particularly, China and USA.

CENTRAL BANKS ACROSS WORLD

Central banks across the world reduced the repo rates(or their equivalent rates) to a varying extent, with Brazil making the highest cuts. No country, including developed economies was an exception. Countries like Japan or Switzerland and even the Europe, which had negative rates before the outset of the pandemic, declined their rates further. However, responses of central banks of China, India and USA are worth comparing to draw a host of lessons.

India and China:

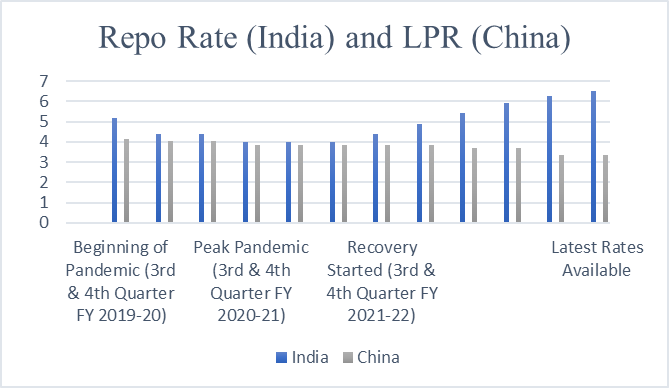

People’s Bank of China (PBC) utilized Loan Price Rate (LPR) (equivalent to India’ repo rate) to a really great extent in combating the economic impact of the pandemic. PBC used as much potential of LPR as possible in doing so. Figure 1 shows the difference between how RBI utilized the repo rate and how PBC used LPR in their combating economic slowdown created by the pandemic.

If we analyse this data, in peak pandemic, PBC reduced LPR from 4% to 3.85%, similarly, RBI brought down the repo rate from 5.15% to 4.4% to 4% and then maintained the rate at 4%. Both central banks reduced their repo rates in order to inject the liquidity in the market. The difference between the response lies in how long the banks maintained the rate at low level.

Reducing repo rate, as already stated, has the risk of rising inflation. By maintaining the rate at the low level for a longer period, PBC risked the inflation, and China ended up doubling its inflation rate from 1% to 2%, from 2021 to 2022. On the other hand, during the same period inflation in India increased from 5.13% to 6.7%. In terms of face value, Indian inflation rate is still much higher than China’s; however, if looked at from the perspective of China experienced 100% rise in its inflation rate, while Indian inflation rate increased by approximately 30.6%. China’s robust economy could afford this 100% increase in inflation rate, but Indian economy couldn’t have, and thus, very pragmatically, RBI started gradually increasing the repo rate as the figure shows.

India and USA:

Similar to India-China comparison, let us now compare USA and India on the same scale of repo rate. Following figure shows the difference between RBI’s policy response to pandemic and that of Federal Bank:

Now this comparison and comparison in the results in terms of inflation rate shows that USA reduced its repo rates to an unconventionally low level, and consequently, from 2021 to 2022, its inflation rate increased from 4.7% to 8%, which indicates 70.21% increase in inflation rate. This compared with aforesaid increase in India’s inflation rate is clearly indicating the extent to which it was important to steadily change the policy rates. US rates were not only unconventionally low, but they were brought down very suddenly. Reducing the policy rate was definitely expected, but the extent of fall was definitely not. This led to inflation rate increasing by approximately 70.21% as stated above.

CONCLUSION AND LESSONS LEARNT

The monetary policy responses of the RBI, PBC, and Federal Reserve to the pandemic are compared in this paper. In contrast, the RBI balanced its approach with repo rate adjustments quite timely to avoid the risks of inflation, all while providing the much-needed injection of liquidity into the system. In contrast, the too-long persistence of low rates at PBC resulted in a significant upside to inflation, while dramatic rate cuts in the Federal Reserve also generated a spectacular rise in inflation. Comparisons, therefore, bring out the clear lesson that policy response to economic crises needs to be cautious and adaptive, carrying useful lessons to manage future global economic shocks with prudence and foresight.